-

Internet Source of revenue: Reported at $10.6 million for Q1 2024, beneath the estimated $12.07 million.

-

Profits In step with Percentage (EPS): Accomplished $0.31 consistent with diluted percentage, falling wanting the estimated $0.36.

-

Income: Main points on overall income now not supplied, comparability to the estimated $91.37 million can’t be made.

-

Dividend: Declared a quarterly money dividend of $0.09 consistent with commonplace percentage.

-

Asset Enlargement: Overall property larger to $9.8 billion, up via $101.4 million from the former quarter.

-

Mortgage Portfolio: Overall gross loans reduced to $7.01 billion, down via $258.5 million because of the sale of Houston-based multifamily loans.

-

Operational Potency: Potency ratio progressed considerably to 72.0% in Q1 2024 from 108.3% in This autumn 2023.

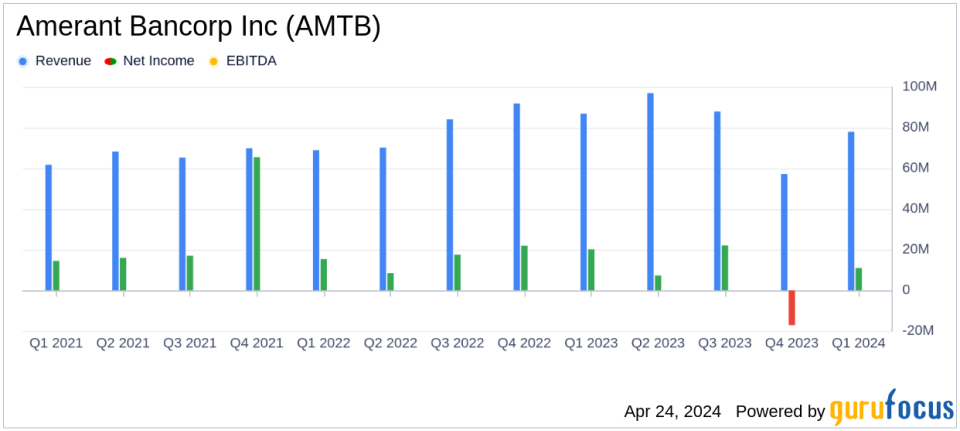

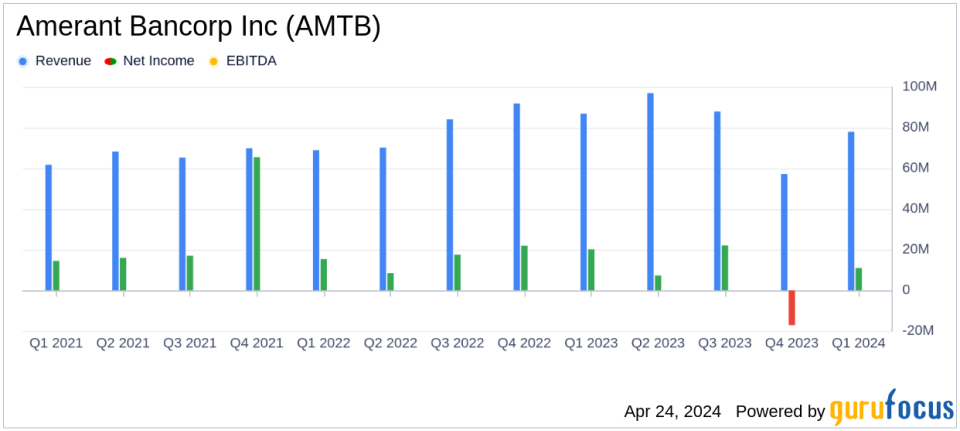

On April 24, 2024, Amerant Bancorp Inc (NYSE:AMTB) disclosed its monetary effects for the primary quarter of 2024 thru an 8-Ok submitting. The corporate reported a internet source of revenue of $10.6 million, or $0.31 consistent with diluted percentage, a vital restoration from a internet lack of $17.1 million within the earlier quarter. In spite of this development, the profits consistent with percentage fell wanting the analyst estimate of $0.36.

Corporate Evaluation

Amerant Bancorp Inc., headquartered in Coral Gables, Florida, is a distinguished financial institution maintaining corporate. Thru its major subsidiary, Amerant Financial institution, it gives a complete vary of products and services together with deposits, credit score, funding, wealth control, and fiduciary products and services to each home and decided on global shoppers. Established in 1979, Amerant operates 24 banking facilities and emphasizes a mix of conventional and virtual banking products and services.

Monetary Highlights and Strategic Tasks

The primary quarter noticed Amerant that specialize in growth and strategic restructuring, together with the outlet of recent places and the sale of its Houston franchise. This era marked a notable build up in overall property to $9.8 billion, reflecting a 1.0% expansion from the fourth quarter of 2023. Alternatively, overall gross loans reduced via 3.6% to $7.01 billion because of the sale of Houston-based multifamily loans, partly offset via natural mortgage manufacturing.

Deposit dynamics have been blended, with a slight lower in overall deposits to $7.88 billion. Nonetheless, natural deposit expansion used to be tough, including $331.8 million. The financial institution additionally reported an build up in money and money equivalents via 104.9%, amounting to $659.7 million.

In spite of those certain tendencies, Amerant confronted demanding situations together with a lower in internet passion source of revenue to $78.0 million and a contraction in internet passion margin to three.51%. The potency ratio progressed dramatically to 72.0% from 108.3% within the earlier quarter, indicating higher price control.

Operational and Marketplace Demanding situations

The aid in internet passion source of revenue and the contraction of the online passion margin underscore ongoing pressures within the banking sector, specifically with regards to rate of interest volatility and aggressive dynamics. Moreover, the lower in overall gross loans highlights the affect of strategic asset gross sales on mortgage portfolio quantity, which might impact long run passion source of revenue.

Investor and Marketplace Reactions

In spite of lacking EPS estimates, the restoration to profitability and the declaration of a quarterly money dividend of $0.09 consistent with commonplace percentage replicate a good turnaround in Amerant’s operational efficiency. Those components, mixed with strategic expansions and asset restructuring, supply a blended but cautiously positive outlook for buyers.

For extra detailed data, together with long run methods and fiscal well being, buyers and stakeholders are inspired to check with the total profits file and supplementary fabrics to be had at the Amerant investor family members web page.

Conclusion

Amerant Bancorp Inc.’s first quarter of 2024 illustrates a duration of restoration and strategic realignment. Whilst demanding situations stay, specifically in mortgage portfolio control and passion source of revenue technology, the corporate’s proactive methods and progressed potency ratios spotlight its resilience and suppleness in a fluctuating banking surroundings.

Discover the whole 8-Ok profits unlock (right here) from Amerant Bancorp Inc for additional main points.

This newsletter first gave the impression on GuruFocus.